Dawn Allcot

·3 min read

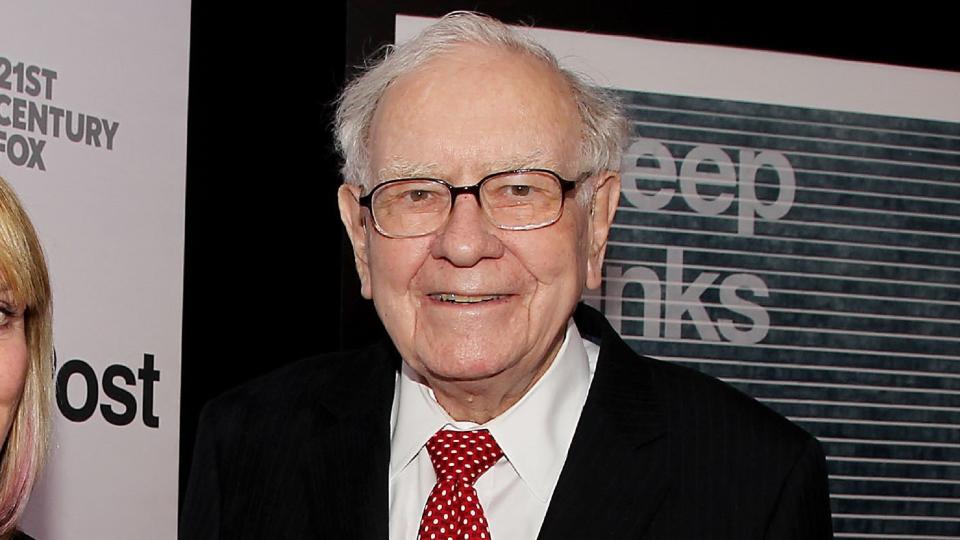

Many people know that Warren Buffett, the Oracle of Omaha, has invested in Coca-Cola stocks for years. His widely-shared philosophy is: “Never invest in a business you cannot understand.”

Explore More: I’m a Financial Advisor: I’d Invest My First $5,000 in These 6 Stocks

Find Out: 6 Genius Things All Wealthy People Do With Their Money

In spite of this, Buffett owns shares of many tech stocks, many in a portfolio owned by a Berkshire Hathaway subsidiary, New England Asset Management (NEAM), according to The Motley Fool.

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

Alphabet Company

While Buffett doesn’t always follow the crowd when it comes to investment choices, he does have exposure in three out of the five “FAANG” stocks (Facebook, Amazon, Apple, Netflix, and Google) through NEAM.

These large-cap tech stocks are all household names. You don’t have to be an expert in artificial intelligence or quantum computing to see the impact Alphabet (or Apple and Amazon, in which NEAM also holds shares) will have on the future.

StoneCo

Not every stock in Buffett’s portfolio is a household name, though. Experts, including analysts at Zacks.com, are rating the Latin America-based fintech solutions provider a “strong buy.”

Buffett invested in the company’s IPO in 2018, according to The Motley Fool, and, although the stock is down 42% from that time, he hasn’t sold.

Snowflake

As with StoneCo, Buffett bought into Snowflake’s IPO several years ago. The cloud-based computing company’s stock showed a steep decline of 20% recently when CEO Frank Slootman announced his retirement. At the same time, first-quarter projections were weaker than expected.

Investors are divided on whether the dip means they should increase their position or not. It will be interesting to see what action Berkshire-Hathaway takes.

Cisco Systems (and Others)

Buffett and NEAM also own a handful of legacy tech stocks, companies that have been around for decades and show staying power. These include Cisco Systems, with a $217 billion market cap, IBM, VeriSign, HP, Texas Instruments, and Activision Blizzard.

Qualcomm and Other Chip Manufacturers

Four semiconductor chip manufacturers round out the tech stocks owned by NEAM or Buffett. All are showing recent gains due to growing demand. Analysts at Zack’s spotlight Qualcomm as a solid buy. Buffett has also invested in Taiwan Semiconductor Manufacturing, Broadcom, and NXP Semiconductors.

Bottom Line

Whether you are considering megacap tech stocks or prefer to take a chance on newer companies, it pays to understand where some of the best investment firms are putting their money.

Of course, you should strive to build a diversified portfolio and never risk more than you can afford to lose, especially in speculative stocks that may not have the staying power of companies like Apple or Amazon.

More From GOBankingRates

Frugal People Love the 6 to 1 Grocery Shopping Method: Here's Why It Works

Social Security: Can Debt Collectors Garnish Your SSI Payments?

This article originally appeared on GOBankingRates.com: These Are the 5 Tech Stocks in Warren Buffett’s Portfolio: Should You Invest?