What are the challenges of mobile payment systems?

One of the biggest challenges for mobile payment professionals is ensuring the security and compliance of their solutions. Mobile payment systems involve sensitive data, such as personal information, card details, and transaction records, that need to be protected from hackers, fraudsters, and identity thieves.

One of the biggest challenges for mobile payment professionals is ensuring the security and compliance of their solutions. Mobile payment systems involve sensitive data, such as personal information, card details, and transaction records, that need to be protected from hackers, fraudsters, and identity thieves.

Mobile payments encompass all transactions and fund transfers conducted via mobile devices. Due to their popularity, they also have become favored for cyberattacks, such as phishing and Man-in-the-Middle (MitM) attacks, which could lead to the theft of financial data and funds.

Limited Acceptance and Reliance on Technology

Although these apps are gaining popularity, not all merchants accept mobile payments. This means that you may still need to carry physical cards or cash as a backup. Additionally, mobile payment apps rely heavily on technology, which can sometimes be a disadvantage.

One of the biggest risks of using mobile payment solutions is data security. Mobile devices and networks are vulnerable to hacking, malware, phishing, and other cyberattacks that can compromise your customers' personal and financial information, as well as your own business data.

Staying compliant with evolving regulations, such as data protection laws and anti-money laundering (AML) regulations, can be challenging for payment service providers, who need to invest in resources and systems to ensure adherence while maintaining operational efficiency.

- Risk of hacking and identity theft.

- Tech issues or bugs can affect usability.

- Some mobile banking apps charge fees.

- Features aren't the same for all apps.

A digital wallet — is even more secure than a chip card because it doesn't use your actual card number for the transaction. As a security measure, your card information is only used in the initial setup of the wallet, helping increase mobile payment protection.

Mobile payment technology offers quick payment processing options. There is no need for data entry, and it reduces wait times. Customers also receive the option to choose digital receipts or invoices. These can be sent through email, text, or to be stored in the app.

A mobile payment is a money payment made for a product or service through a portable electronic device such as a tablet or cell phone. Mobile payment technology can also be used to send money to friends or family members, such as with the applications PayPal and Venmo.

What is the disadvantage of faster payment system?

- Risk: Payments once sent, cannot be cancelled or traced – even if you realise you've paid the wrong person.

- Notification: Your operatives do not get a text message regarding their payment.

- Not guaranteed: No compensation if your Faster Payment fails to arrive.

Current security concerns with digital payments

Digital payments are vulnerable to security concerns such as data breaches, fraud, and identity theft. Data breaches occur when sensitive information such as credit card numbers and personal information is accessed without authorization.

Security Concerns: E-payment systems are susceptible to cyber threats and hacking, posing risks of unauthorised access, data breaches, and financial fraud.

The bottom line. Digital wallets can be even safer and more secure to use than plastic credit cards, cash, checks and other forms of physical payment. But research digital wallet apps carefully and read reviews before committing to one.

A cashless society would rely on a complex network of digital systems, which would be vulnerable to cyberattacks. If these systems were hacked, it could have a devastating impact on the economy. There are also concerns about privacy. When people pay with cash, their transactions are anonymous.

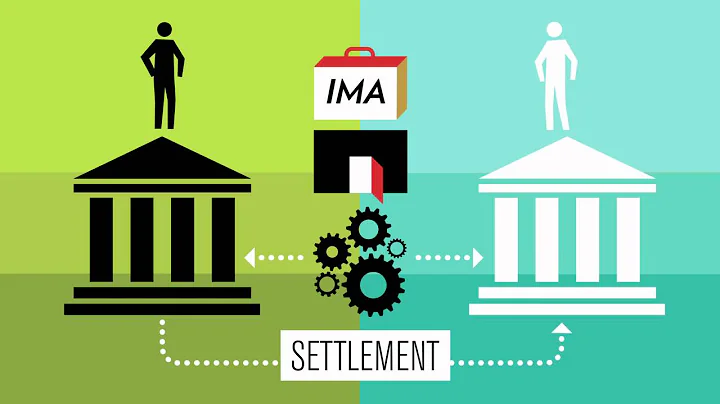

The payment gateway securely encrypts the customer's payment data and sends it to the payment processor. The payment processor receives the encrypted payment data from the payment gateway and forwards it to the customer's bank (the issuing bank) to request authorization for the transaction.

Risk of fraud and hacking

With cashless payments, more financial information is stored online, so there is a higher chance that information can be stolen by cybercriminals. Cashless payments can also be vulnerable to hacking and other forms of digital fraud.

Mobile payments: future market insights.

The global market size of mobile payments is forecasted to reach $18.84 trillion in 2030, up from $2.98 trillion in 2023. Any guesses why that is? In short, it's thanks to the increased penetration of smartphones and the popularity of e-commerce platforms.

The Federal Communications Commission (FCC) has jurisdiction over wireless carriers and is responsible for the Truth-in-Billing rule. Mobile payments products that include wireless bill charges as a payment method may be subject to the FCC's authority.

The primary challenges in online payments are fraud and chargebacks, cross-border transactions, card data security, multi-currency and payment methods, technical integrations, etc.

What are the 4 types of electronic payment systems?

- Debit Card. A debit card is a card with unique credentials and is linked to the customer's bank account. ...

- Credit Cards. Credit cards are the most popular form of payment for e-commerce transactions. ...

- E-Wallet. ...

- Smart Card. ...

- Online banking. ...

- Mobile Payment.

E-payments are convenient, fast, and secure, but they also come with various risks, such as fraud, cyberattacks, compliance issues, and operational failures. To protect your business and your customers, you need to design and implement an effective e-payment risk management framework.

Payment banks cannot issue credit cards. It cannot accept time deposits or NRI deposits. It cannot issue loans. It cannot set up subsidiaries to undertake non-banking financial activities.

Online banking does have some potential disadvantages. These include a lack of face-to-face customer support, cash deposit services and a risk of technology failures or security breaches.

- No physical branches when you need help.

- Challenging cash deposits.

- No access to foreign currency.